In this detailed Curadebt review, we’ll explore:

- Who CuraDebt is and how they operate

- Why they are a preferred choice for debt relief

- Pros and cons of using their services

- Why they are highly recommended by financial experts

This is an expert Curadebt review. Debt can be overwhelming, affecting your financial stability and peace of mind. If you’re struggling with unsecured debts like credit cards, medical bills, or personal loans, CuraDebt may be a solution worth considering. As one of the most trusted debt relief companies in the U.S., CuraDebt has helped thousands of clients reduce their debt burdens through customized programs.

Who Is CuraDebt?

Founded in 2000, CuraDebt is a nationally recognized debt relief company specializing in debt settlement, tax debt relief, and debt consolidation. Unlike many competitors that focus solely on credit card debt, CuraDebt provides a broader range of services, including:

- Debt settlement (negotiating lower payoff amounts)

- Tax debt resolution (helping with IRS and state tax debts)

- Debt consolidation (combining multiple debts into one manageable payment)

CuraDebt is accredited by the American Fair Credit Council (AFCC) and maintains an A+ rating with the Better Business Bureau (BBB), reflecting its commitment to ethical practices and customer satisfaction.

Why Is CuraDebt the Preferred Debt Relief Expert?

Several factors make CuraDebt stand out among debt relief providers:

1. 20+ Years of Industry Experience

With over two decades in the debt relief space, CuraDebt has refined its strategies to maximize savings for clients while maintaining compliance with federal and state regulations.

2. Customized Debt Relief Solutions

CuraDebt doesn’t use a one-size-fits-all approach. They assess each client’s financial situation and recommend the best strategy, whether it’s settlement, consolidation, or tax relief.

3. No Upfront Fees

Unlike some debt relief scams, CuraDebt does not charge fees until they successfully settle a debt, ensuring clients only pay for results.

4. Legal Tax Debt Assistance

Many debt relief companies avoid tax-related debts, but CuraDebt has a dedicated tax division that negotiates with the IRS and state agencies to reduce penalties and set up affordable payment plans.

5. Strong BBB Reputation & Positive Reviews

CuraDebt maintains an A+ BBB rating and has numerous positive customer reviews, highlighting their transparency and effectiveness.

Pros and Cons of CuraDebt

✅ Pros:

✔ Proven track record – Over 20 years in business with thousands of resolved cases.

✔ No upfront fees – Clients only pay after a settlement is reached.

✔ Wide range of services – Handles credit card debt, personal loans, medical bills, and tax debt.

✔ Free consultation – No obligation to enroll after the initial assessment.

✔ Legal compliance – Follows Telemarketing Sales Rule (TSR) and Fair Debt Collection Practices Act (FDCPA) guidelines.

❌ Cons:

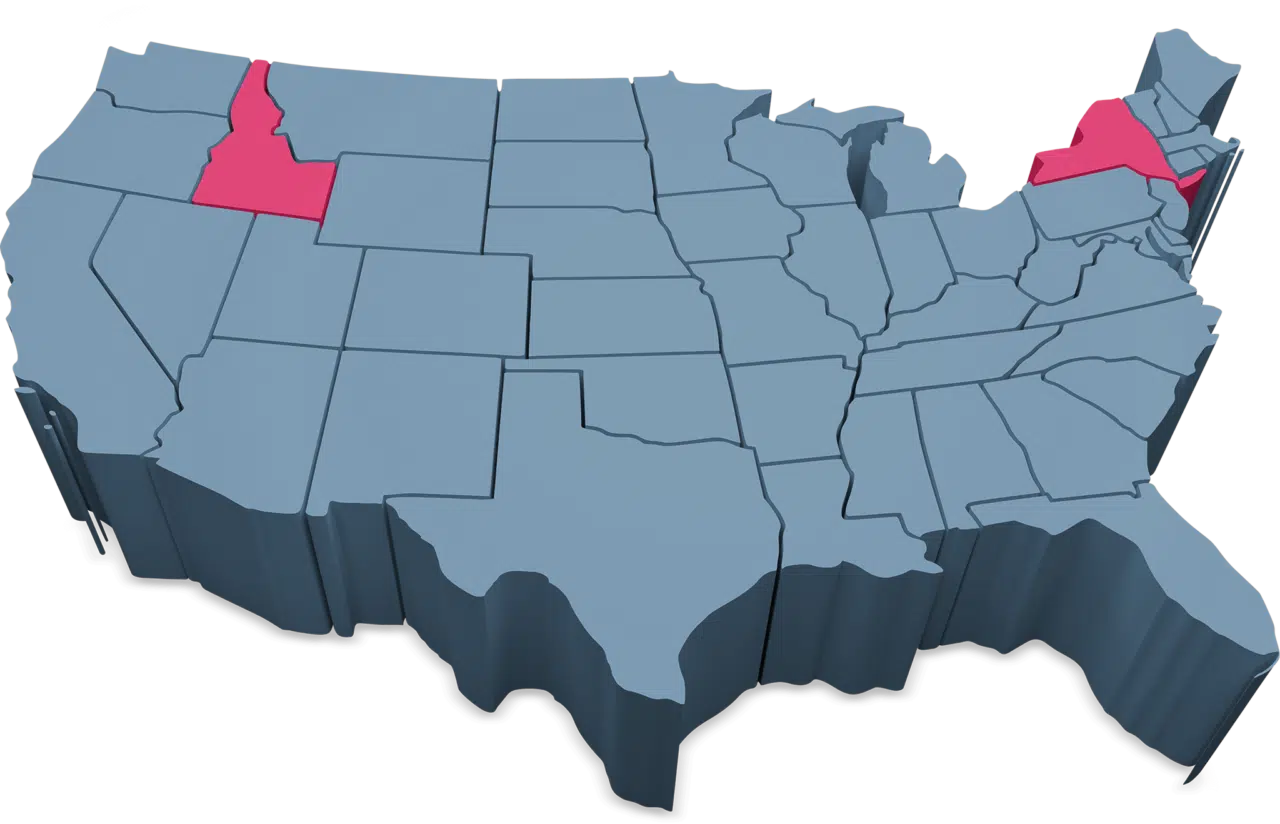

✖ Not available in all states – Due to varying state regulations, some services may be limited.

✖ Potential credit score impact – Debt settlement can temporarily lower credit scores.

✖ Not ideal for secured debts – Focuses on unsecured debts (not mortgages or auto loans).

Why Is CuraDebt Highly Recommended?

CuraDebt is frequently recommended by financial experts and satisfied clients for several reasons:

1. Ethical and Transparent Practices

They provide clear contracts with no hidden fees, ensuring clients understand the process before committing.

2. High Success Rate

Their experienced negotiators secure debt reductions of 30%-50% on average, helping clients save thousands.

3. Financial Education & Support

CuraDebt educates clients on debt management and budgeting, helping them avoid future financial pitfalls.

4. Alternative to Bankruptcy

For those considering bankruptcy, CuraDebt offers a less damaging alternative, allowing clients to resolve debts without court involvement.

Final Verdict: Is CuraDebt Right for You?

If you’re struggling with $10,000 or more in unsecured debt, CuraDebt could be an excellent solution. Their proven negotiation tactics, tax debt expertise, and client-first approach make them a top choice for debt relief.

However, if you have minimal debt or strong credit you want to preserve, exploring credit counseling or balance transfers might be better options.

Why CuraDebt Is The Best Choice

With over 24 years of experience, CuraDebt stands out as a trusted leader in debt relief. Here’s why:

- Guaranteed Lowest Fees: We’ll beat any competitor’s written quote from a reputable company.

- BBB A+ Accredited: Proudly accredited with an A+ rating by the Better Business Bureau.

- Comprehensive Solutions: We advise on loans, debt settlement, bankruptcy alternatives, tax debt relief, and business debt issues.

- Top Ratings: CuraDebt is highly rated across multiple platforms, with 4.9 on Shopper Approved, 5.0 on Customer Lobby, 4.5 on Trustpilot, and 4.8 on Google Reviews.

- Skilled Counselors: Our team includes professionals with diverse financial, legal, and tax backgrounds.

- Massive Client Savings: We’ve negotiated millions in settlements, saving clients thousands of dollars.

- Extensive Success Record: Over 200 settlement letters posted online with reductions up to 100% (results vary).

- Transparent Process: Clear disclosure of all fees and customized payment plans.

- Business Debt Help: Specialized assistance for business owners facing financial challenges.

- Tax Debt Solutions: Full-service support for IRS debt, back taxes, audits, and tax relief programs.

- Licensed And Bonded: Licensed in multiple states for maximum consumer protection.

- BSI Certified: Certified by the British Standards Institution for excellence and quality assurance.

- Top Customer Reviews: With over 1,400 five-star reviews, clients consistently praise our support, professionalism, and results.

Take control of your debt—consolidate wisely and save!

Next Steps

Interested in learning more? CuraDebt offers a free, no-obligation consultation to assess your debt situation and recommend a tailored plan.

📞 Contact CuraDebt Today – Take the first step toward financial freedom!